XRP is attempting to stabilize above the $1.90 level after slipping below the $2.00 mark, a breakdown that has fueled fresh uncertainty across the market. With momentum weakening and volatility picking up, traders are now watching whether this pullback becomes a temporary reset or the start of a deeper downside move.

Analysts remain divided on the outlook, as some argue XRP is entering a bearish continuation phase, while others believe the market is simply clearing leverage before a rebound. Either way, the coming sessions are shaping up to be decisive for short-term direction.

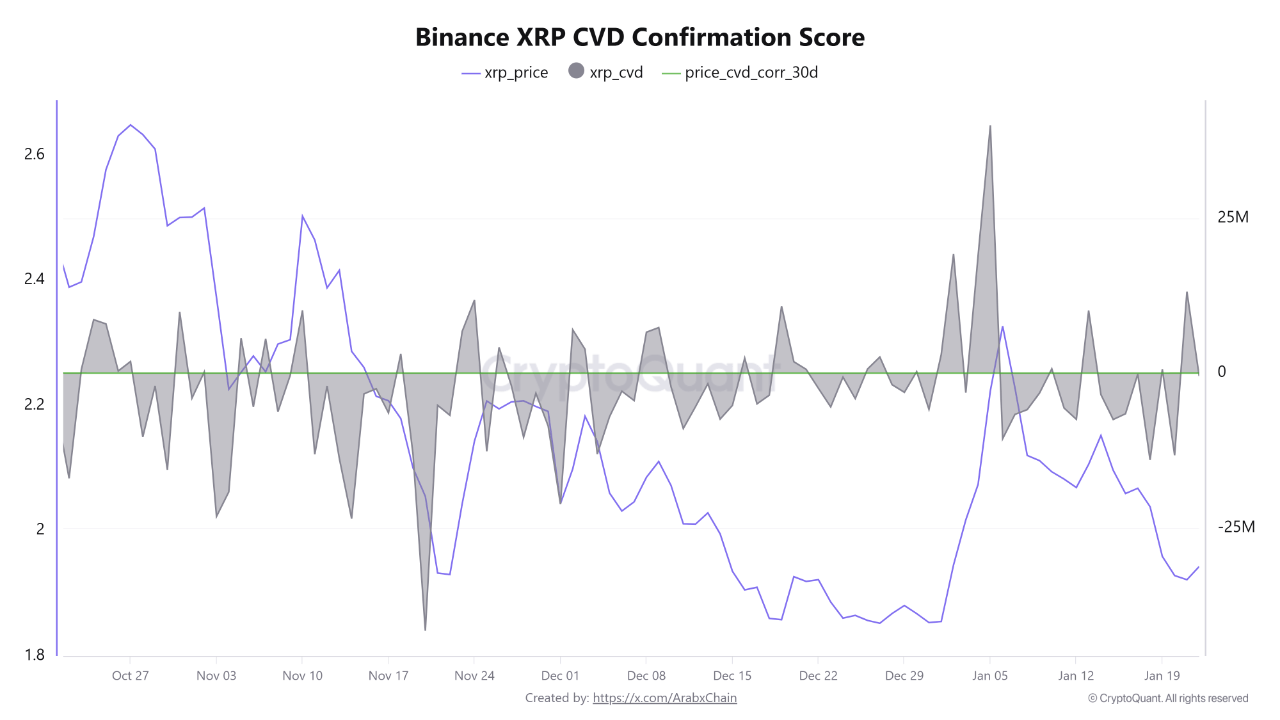

A report from Arab Chain adds an important layer of context by focusing on Binance flow dynamics. According to the report, data from Binance’s XRP platform shows the 30-day correlation between price and CVD (Cumulative Volume Delta) sitting near 0.61, which signals a moderate to strong positive relationship between price action and net volume flows. In simple terms, XRP’s recent moves have not been disconnected from trading activity.

Instead, price changes appear to be relatively supported by actual volume behavior rather than isolated technical noise.

This matters because when price and CVD remain positively linked, the market is often viewed as structurally aligned, suggesting trend confirmation rather than a random bounce. For XRP, this correlation could become a key signal as bulls fight to defend $1.90.

XRP’s CVD Confirmation Score Shows Base-Building, Not Capitulation

Arab Chain explains that while the 30-day price–CVD correlation remains positive, the latest CVD reading is still relatively negative, signaling that accumulated selling pressure has not yet flipped into net buying dominance. This is a critical nuance.

Rather than acting like a simple “buy” or “sell” trigger, the metric functions as a confirmation score, meaning it evaluates whether price action is internally supported by volume flows instead of offering a clean entry signal. In other words, it helps traders judge the quality of the trend and whether market behavior is coherent beneath the surface.

The real value of this framework is its ability to detect divergence early. If XRP’s price attempts to recover while correlation deteriorates, or if CVD stays negative during upside moves, it would suggest hidden weakness and a higher probability that rallies are being sold into. That kind of imbalance often appears before sharp reversals, especially in uncertain conditions where liquidity is thin and momentum-driven positioning dominates.

In the current context, however, the market is sending a more balanced message. The persistence of a positive correlation despite ongoing price weakness implies that XRP may be entering a base-building phase, where selling pressure is being absorbed gradually rather than accelerating into aggressive distribution.